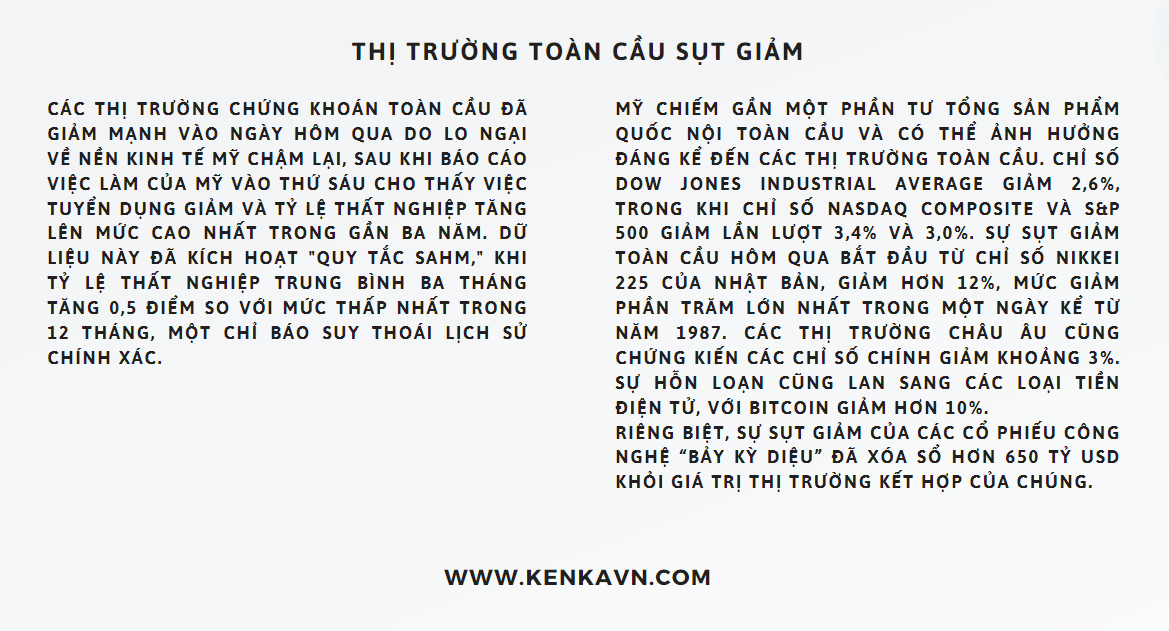

Global Markets

Global stock markets dropped sharply yesterday because people are worried about the slowing US economy. A recent jobs report showed that hiring is slowing down and unemployment has increased to its highest level in almost three years. This news triggered something called the "Sahm Rule." This rule says that when the average unemployment rate goes up by 0.5 points over three months, it can mean a recession is coming.

The US economy is very important, making up nearly a quarter of the world’s total economic output. Because of this, changes in the US economy can greatly affect global markets. The Dow Jones Industrial Average, a major stock index, fell by 2.6%. The Nasdaq composite and S&P 500 also went down, dropping by 3.4% and 3.0%, respectively.

The decline started in Japan, where the Nikkei 225 index fell by more than 12%. This was its biggest drop in one day since 1987. In Europe, major stock indexes also fell by about 3%. The problems even affected cryptocurrencies, with Bitcoin dropping by more than 10%.

Additionally, losses in the “Magnificent Seven” tech stocks, which are seven major technology companies, caused a loss of over $650 billion in their total market value.

0 Comments