Gold price today (24-April): The prices of some domestic gold brands continue to decrease sharply, with the highest decrease reaching nearly 1 milion VND/tael in selling session.

A person arranges gold jewelry at a shop in Ho Chi Minh City. Photo by VnExpress/Quynh Tran

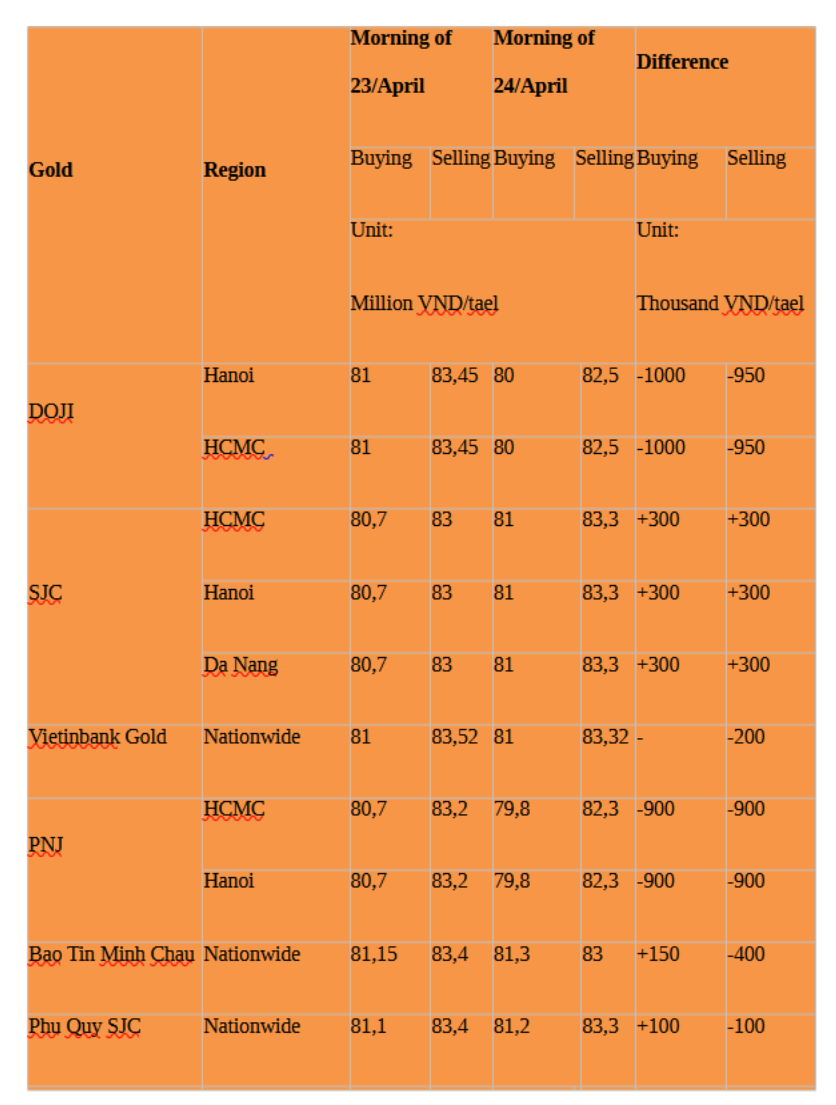

Domestic gold price today

Curently, the specific listed prices of gold brands are as follows:

The SJC gold price in the Hanoi, Danang, and Ho Chi Minh City areas is listed at 81 million VND ($3183.02)/tael for selling. Therefore, compared to early morning, the SJC gold price has been adjusted to increase by 300,000 VND ($11.79) in both buying and selling sessions.

Domestic gold prices decrease sharply. Photo by tuoitre.vn

In Hanoi, DOJI has adjusted the buying and selling prices of gold bullion, reducing them to 80 million VND/tael ($3143.73) for buying and 82.5 million VND/tael ($3241.97) for selling, down by 1 million VND ($39.30) and 950,000 VND ($37.33) respectively. In Ho Chi Minh City, this brand of gold is being bought and sold at similar levels to those in Hanoi.

Vietinbank has listed the buying and selling prices at 81 million VND/tael ($3183.02) for buying and 83.32 million VND/tael ($3274.19) for selling, decreasing the selling price by 200,000 VND ($7.86). For PNJ gold, the buying price is 79.8 million VND/tael ($3135.87) and the selling price is 82.3 million VND/tael ($3234.11), decreasing by 900,000 VND ($35.37) for both buying and selling.

The buying and selling prices of Bảo Tín Minh Châu gold are currently 81.3 million VND/tael ($3194.81) respectively, increasing by 150,000 VND ($5.89) for buying but decreasing by 400,000 VND ($15.72) for selling. Phú Quý SJC is buying gold bullion at 81.2 million VND/tael ($3190.88) and selling it at 83.3 million VND/tael ($3273.41), increasing the buying price by 100,000 VND ($3.93) but decreasing the selling price by 100,000 VND ($3.93).

Domestic Gold Bullion Prices updated at 5:30 a.m. on April 24

WORLD GOLD PRICES Today

WORLD GOLD PRICES edged lower with spot gold falling by 5.4 USD to 2,321.5 USD/ounce. The last trading of future gold was at 2,334.7 USD/ounce, down 5.5 USD from yesterday morning.

Gold prices continued to decline as concerns about escalating tensions in the Middle East eased, while investors are still awaiting important data from the US for further clues about the trajectory of the interest rates by the Federal Reserve. (the term "trajectory of the interest rates" refers to the expected path/direction of movement of interest rates over a period of time. This can include whether interest rates are expected to increase, decrease, or remain stable, and the pace at which any changes may occur.)

According to market analyst Tim Waterer of KCM Trade, gold has attracted buying interest from various sources in recent months, and one of those sources has now dried up due to diminishing demand for safe-haven assets.

Earlier in the week, gold had dropped more than 2%, marking its biggest one-day decline in over a year, as concerns about a widespread regional conflict eased after Iran indicated it had no plans for retaliation following an attack by Israel. Waterer believes that investors are viewing this as an opportunity to take profits after the recent rally in the price of this precious metal (A recent significant increase in the price of gold). On April 12, gold had reached a record high of 2,431.29 USD/ounce.

Key economic data expected by the market this week include the Gross Domestic Product and the Personal Consumption Expenditures Index. Waterer stated that stronger economic data would make the Fed more confident in its plan to maintain high interest rates for a longer period. This scenario would cause gold to continue its downward trend.

World gold prices decrease. Photo by Kitco

Recent comments from Fed officials have all hinted that there is no rush to cut interest rates. This has reduced the appeal of gold bars. Traders expect the Fed to start pivoting its policy in September.

According to market analyst Fawad Razaqzada of City Index, many investors have missed the recent significant recovery of gold and will look to enter the market during such price declines.

With domestic gold prices plummeting and world gold prices listed on Kitco at 2,321.5 USD/ounce (equivalent to nearly 71.3 million VND/tael ($2801.85) based on the Vietcombank exchange rate, excluding taxes and fees), the price difference between domestic and world gold prices is approximately nearly 12 million VND/tael ($471.56).

0 Комментарии