With Tet approaching and countless expenses piling up, many people have had to borrow money to cover their year-end costs as everything seems to require spending. However, when taking loans, one should carefully calculate the amount based on their financial capacity if they don't want to struggle with heavy burdens in the months after Tet.

Borrowing 100 million VND for Tet expenses

Recently, a post shared by a couple who decided to borrow 100 million VND for Tet expenses has caught significant attention on social media. The couple reportedly earns a combined monthly income of 20 million VND (wife's salary is 7 million, husband's is 13 million).

The wife shared: "Every Tet, our family ends up in debt. This year, with the economic difficulties, my husband had to borrow 100 million VND for Tet expenses because his company delayed salaries and didn't give Tet bonuses. We planned to use this amount for Tet, and if there's any money left, we wanted to open a snack shop instead of continuing our jobs. However, our Tet month expenses have already used up almost all of the borrowed money."

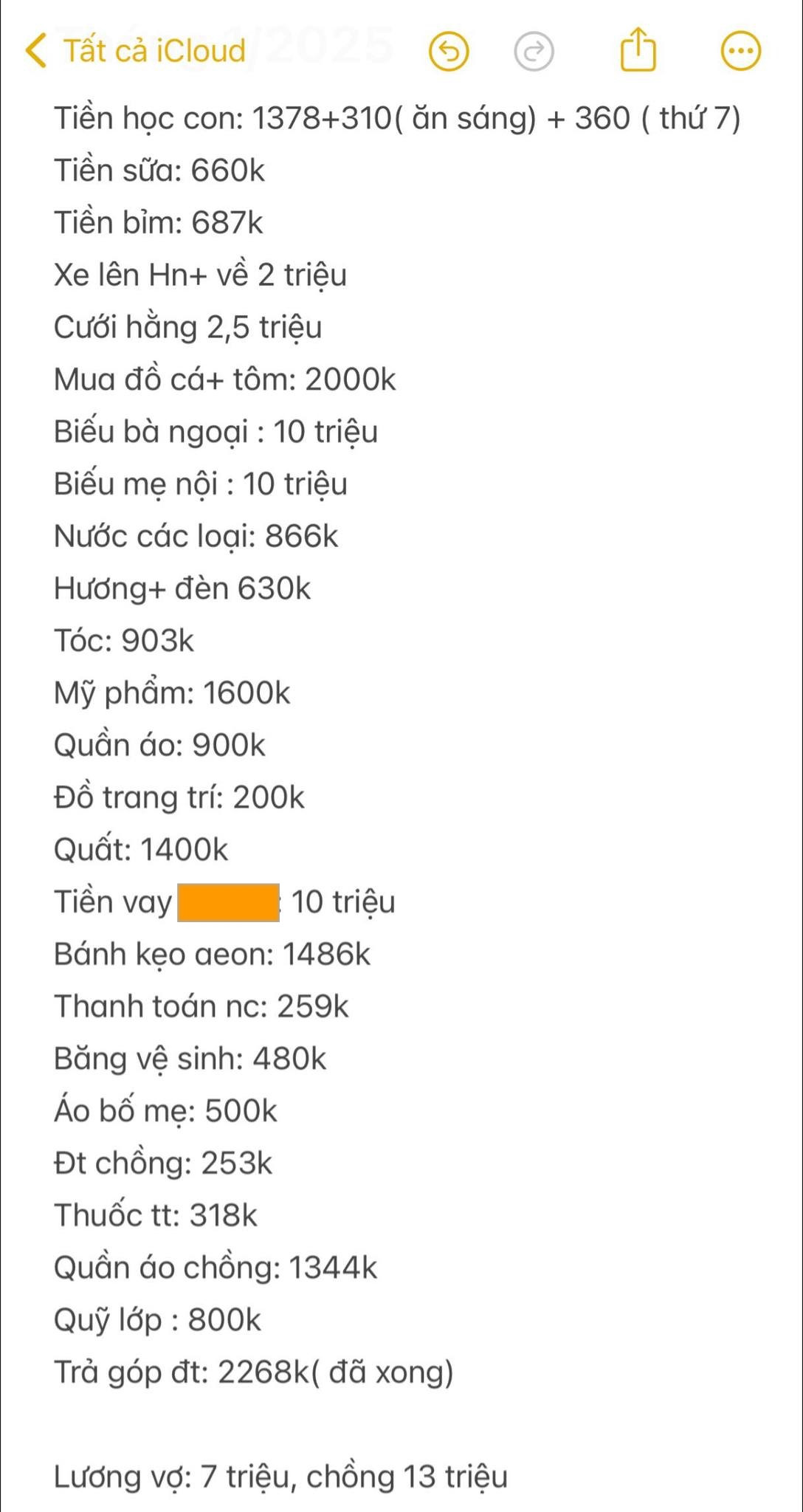

Along with her confession, the wife also shared their family's Tet month expense sheet, showing total spending of around 54.1 million VND.

Looking at this family's shared expenses, many netizens were shocked and advised them to recalculate their Tet spending budget. Since the couple is already in debt, they suggested identifying areas where expenses could be reduced to minimize the financial burden after the holiday season.

Below are some comments on the post:

*- "This might sound harsh, but if you don't have money and borrow to give each set of parents 10 million, would your parents feel comfortable spending that money if they knew? Then getting your hair done for 900,000 and buying cosmetics for 1.6 million when the wife's salary is 7 million and husband's is 13 million. If your family is still struggling financially, couldn't you cut back on these expenses?"

*- "You should reconsider your choices. When you don't have money, you don't need to spend on haircuts, cosmetics, and clothes. For parents, give more when you have more, and less when you're borrowing. If you fall into debt, you'll suffer and make your parents worry too."

*- "Times are tough with inflation, but looking at your spending list leaves me speechless. If we're poor, shouldn't we reduce unnecessary spending? You're even borrowing money with interest to spend. You don't have money but give each set of parents 10 million. In our family, though we thankfully earn several tens of millions, we only give each set of grandparents a few million for Tet because we have children's expenses to consider. We need to eat all year, not just during Tet. Or are you planning to feast during Tet and starve the rest of the year?"

*- "With your household income of 20 million, I thought it was 60 million. Your salary is quite average, and while you're in debt, reducing shopping and giving less to parents wouldn't make them blame you at all."

What can we learn from this family?

Lunar New Year (Tet) is a time for us to reflect on and enjoy the achievements of the past year while welcoming the new one. Because of this, many people tend to overspend during this traditional end-of-year festival. However, every celebration must end, and after Tet, we still face numerous living expenses. Therefore, careful financial planning is essential to avoid falling into debt and financial stress after the holiday season.

- Be Cautious When Borrowing Money for Tet

As Tet approaches, the demand for borrowing money increases significantly compared to normal times. However, you should only borrow an amount that aligns with your personal financial situation. Never borrow multiple times your monthly income, as this ensures you can repay both the principal and interest. Additionally, it's crucial to research and choose reputable lending institutions, avoiding those with extremely high interest rates if you don't want to fall into the trap of loan sharks. Remember that while Tet is important, it's not worth compromising your financial stability for temporary celebrations. Consider your regular monthly expenses and ensure you have enough savings to cover them even after spending on Tet festivities. This way, you can enjoy the holiday season without the burden of excessive debt weighing on your shoulders in the months that follow.

- Don't Overspend During Tet Beyond Your Family's Financial Means

Going through Tet can easily leave you "empty-handed" if you spend every penny you have. Therefore, calculating appropriate Tet expenses that match your family's financial situation is crucial.

One approach you might consider is creating a list of expenses as detailed as possible. From your planned budget for this Tet, sit down and make a comprehensive list of necessary expenditures. Categories may include lucky money (li xi), transportation costs, Tet gifts for relatives and friends, food shopping expenses, home decoration costs, new clothing purchases, household items, and more. For each category, estimate how much money you plan to spend.

The more detailed this list is, the easier it becomes to manage your money and avoid overspending. It also helps ensure you don't forget any essential Tet preparations. Don't think of this as a waste of time because, in reality, a specific list will help you optimize your spending most effectively.

-----

Source: cafebiz / 27/Jan/2025/ https://cafebiz.vn/buc-anh-cua-cap-vo-chong-vay-100-trieu-tieu-tet-khien-hang-ngan-nguoi-noi-da-ga-176250127170519876.chn

0 Comments