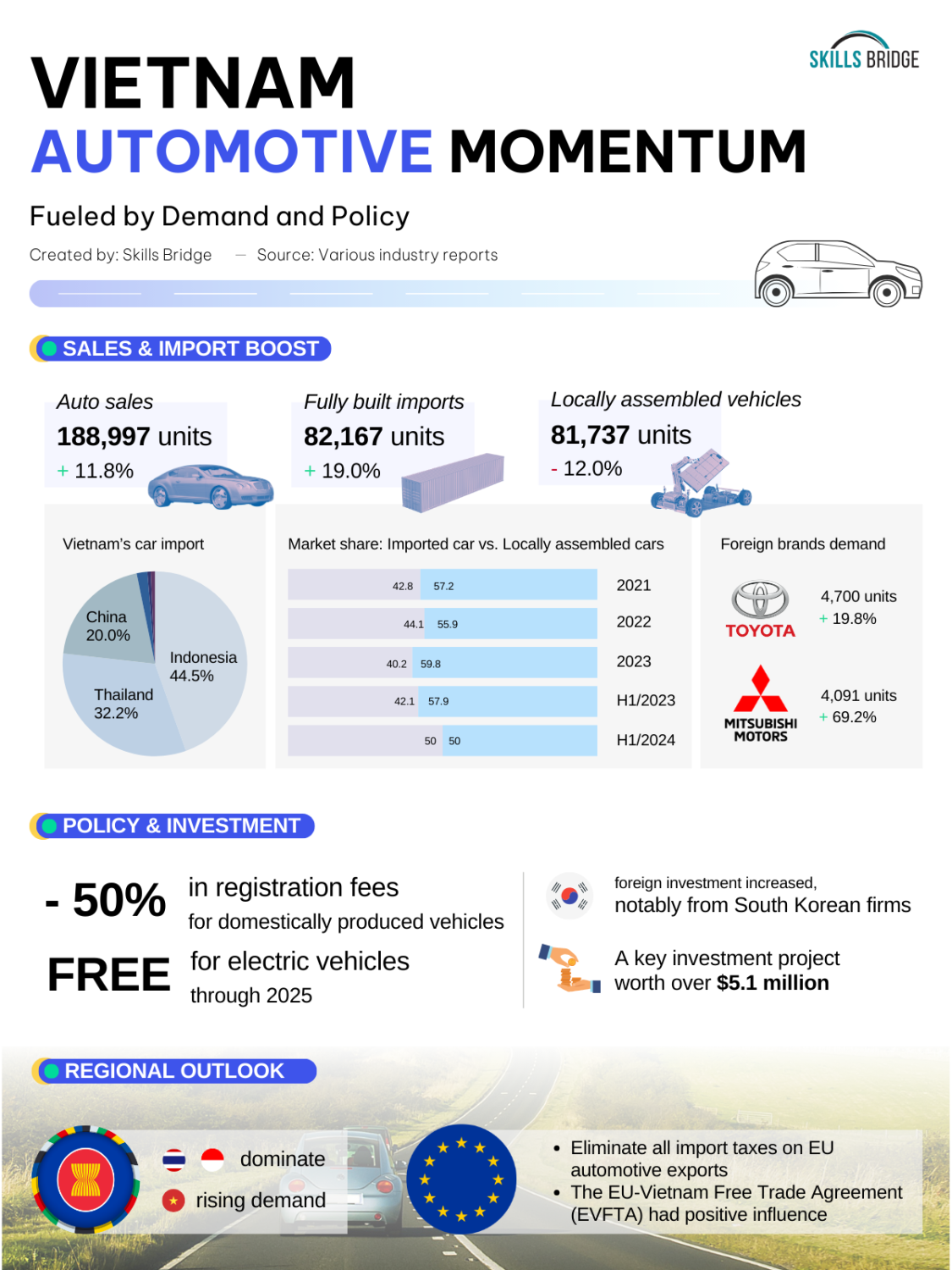

- Vietnam's automotive industry is experiencing significant growth, with car sales rising 11.8% and imports surging 19% from January to August 2024.

- The government's supportive policies, including reduced registration fees for domestic vehicles and incentives for electric vehicles, are stimulating market demand.

- Foreign investments, particularly from South Korean firms, are bolstering the automotive components sector, with a notable USD5.1 million project aimed at producing various car parts.

- While Vietnam's automotive market is smaller compared to regional leaders like Indonesia and Thailand, its expanding middle class, rising demand, and strategic trade agreements position it for continued growth and increased competitiveness in Southeast Asia's automotive landscape.

Source: Skills Bridge

Vietnam's car industry is growing fast, with car sales reaching 188,997 units from January to August 2024, showing an 11.8% increase from last year. The market is bolstered by rising imports, which went up by 19%, while locally made car sales dropped by 12%.

According to a LinkedIn post by Mr Hoang Hai, it's important to explain some things clearly to readers. The 188,997 units include both commercial vehicles (trucks and buses) and passenger cars. Also, 20% of imports come from China, but this includes heavy trucks and not exclusively passenger cars. These two types of vehicles are subject to different import taxes.

Vietnamese policies and foreign investments are further fueling industry growth, especially in car parts manufacturing.

1. Growth in car sales and imports

From January to August 2024, Vietnam's automobile sales rose by 11.8%, with 188,997 vehicles sold. The country witnessed a 19% surge in fully built imports to 82,167 units, while sales of locally assembled vehicles dropped by 12%, signaling a shift toward higher-cost imports, largely driven by demand for foreign brands. Toyota with 4,700 units sold (19.8% increase) and Mitsubishi with 4,091 units sold (69.2% growth) lead the local market, with both showing strong year-on-year growth.

2. Government policies and foreign investment

The Vietnamese government's supportive policies, including a 50% reduction in registration fees for domestically produced vehicles and full fee waivers for electric vehicle through 2025, have stimulated demand in the automobile market. This, combined with increasing foreign investment, notably from South Korean firms, is strengthening the automotive components sector. A key investment project worth over USD5.1 million, aims to produce parts for engines, brakes, and heavy machinery by 2026. Vietnam continues to grow as a hub for automotive manufacturing and components.

3. Regional comparison and market potential

While Vietnam is experencing growth, its automotive market remains smaller compared to neighboring countries. Indonesia and Thailand dominate the ASEAN market with more extensive local production and export networks. However, Vietnam's expanding middle class, rising demand, and strategic trade agreements with ASEAN and Europe offer potential for the country to close this gap in the coming years.

Vietnam's automobile industry is set for continued growth, supported by rising imports, strategic government policies, and foreign investment. While it trails regional leaders, the market's expanding infrastructure and consumer base, position it as a future contender in Southeast Asia's automotive landscape.

Vocabulary

- bolster: (v) to improve something.

- trail: (v) to be losing in a game.

- contender: (n) similar to a candidate.

0 تعليقات