I (Michael W. Sonnenfeldt) started a special group for wealthy people where members pay $33,000 each year. Let me tell you what happens in our meetings.

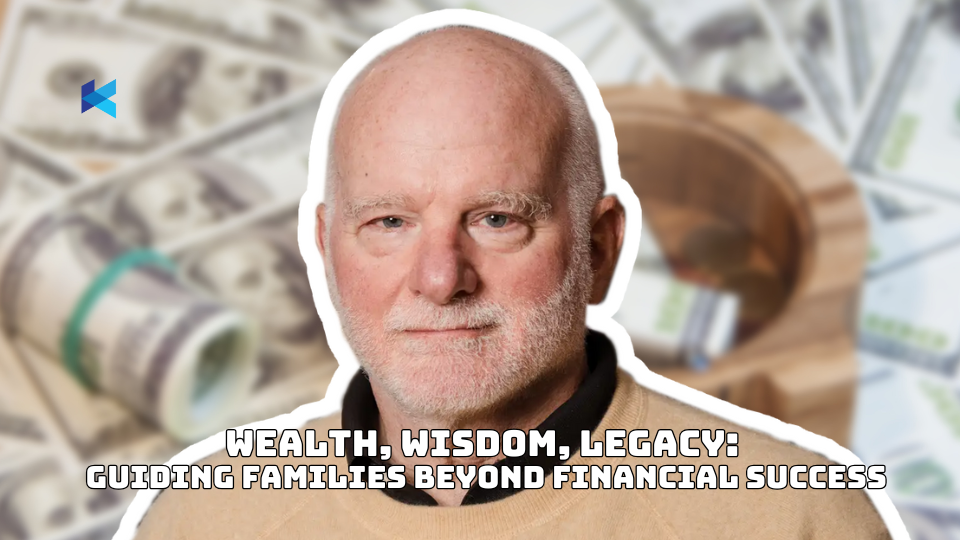

This as-told-to essay is based on a transcribed conversation with 69-year-old Michael W. Sonnenfeldt, the founder of TIGER 21, a membership organization for high-net-worth individuals. The following has been edited for length and clarity.

Michael W. Sonnenfeldt described himself as "member No. 1" of TIGER 21. (Source: Courtesy of TIGER 21 / BI)

I became quite successful when I was just 31 years old. I did very well in real estate by developing the Harborside Financial Center. When I was 25, my partner and I bought an old warehouse. We had a plan to change it into a modern building for computers, and we sold it a few years later for a good profit.

After that, my next business project didn't go well, and I lost some money. Then I started a real estate bank called Emmes, which I sold in 1998.

When I sold Harborside, I didn't know much about wealth preservation. When you're 30, you think more about making new deals than keeping your money safe. But losing money in my next project taught me an important lesson. After selling Emmes, I wanted to make sure I wouldn't lose the money I had made.

In 1999, I created TIGER 21, a group where wealthy people can meet and talk about their money and their lives. I wanted to learn from other smart people about how they were protecting their wealth.

In our group, very wealthy members can safely share their investment plans and get advice. They also talk about how to raise their children well. We've learned many valuable things from these discussions.

I started TIGER 21 to support entrepreneurs who'd sold businesses

Even though I'm the founder and leader of TIGER 21, I think of myself first as "member No. 1."

I began with six people I met through Vistage, an organization that helps business leaders. These people, like me, had sold their businesses and weren't company leaders anymore.

I asked these people to join a new group that would focus on changing from running businesses to managing investments and wealth preservation.

We created the group because we realized that after selling your business, you need to learn new things about your future. It's not just about money - it's about leaving a good legacy, taking care of your children, staying healthy, and helping your community.

Most of our members are people who made their own money, like business leaders or entrepreneurs who sold their companies. They didn't grow up rich, so they need help learning how to manage their wealth.

Some of our members got their money from their families and need to learn how to manage it well. Having both types of members - those who made their money and those who inherited it - is very helpful. The people who made their wealth can learn how their children might handle money in the future, and those who inherited can better understand how their family members worked hard to create that wealth.

In our meetings, members talk openly about their problems and share details about where they invest their money.

When we started in 1999, members needed to have at least $10 million to invest to join TIGER 21. Now, you need to have at least $20 million to become a member. We have grown to almost 1,600 members.

Having enough money isn't the only thing we look for in new members. We check for what we call the "five Cs": character, contribution, capacity, conditions, and capital.

To join TIGER 21, members pay about $33,000 each year, plus a first-time fee of $5,000.

The main part of being in our community is attending a full-day meeting every month in small groups. We begin by talking about what's happening in the world, like a "personal board of directors" would do. Each person shares how recent news has changed their thoughts about investing and life.

Then, we talk about important issues that members are dealing with, such as family matters or investment choices.

Usually, we invite someone to speak at each meeting about topics like protecting nature or understanding China. At the end, one member shows their investment plan to the group for about 90 minutes. Everyone promises to keep everything private.

Members also talk a lot about how to raise their children and pass on their wealth safely.

When planning to give money to your children, you need to think about taxes, but there are other important things too. Should you give the same amount to each child? How should you plan your estate?

Every group talks about these things, but we also have a family office division (special family office section) for this. This is for private businesses established by families for financial management (people who run their family's money management businesses). They meet separately from regular groups to talk about estate planning, family rules, and planning for the future. It costs $50,000 yearly plus a $5,000 first-time fee to join this section.

In all of TIGER, members worry most about how to raise their children well, even more than about wealth preservation. In every meeting, we spend time talking about situations with members' children and finding good ways to handle them.

During a recent family office meeting, I listened to two members sharing their different approaches to parenting. One member explained how they teach their children about money by making them do tasks like raking leaves and saving for their first car. This helps the children understand the value of hard work and wealth preservation. Another member talked about their family's "charter," outlining the family's values.

We often discuss these different methods and what works best for each family.

One thing is clear: It doesn't matter how much money you have, if you do something smart, it'll pay off. And if you do something stupid, it'll kick you in the butt.

-----

Source: Business Insider / Feb 14, 2025/ https://www.businessinsider.com/tiger-21-founder-wealth-preservation-network-2025-2

0 Comments